A Brief Summary of Bioss’ Approach to Risk.

“The Chinese symbol for risk is a combination of danger and opportunity. This definition captures perfectly both the essence of risk and the problems with focusing purely on risk reduction. Any approach that focuses on minimising risk exposure will also reduce the potential for opportunity”.

Aswath Damodaran (2007).

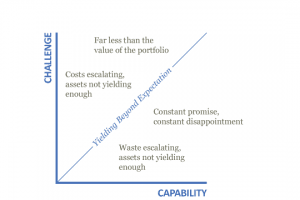

Bioss uses the image of ‘flow’ to understand the risks and opportunities for organisations operating in complex environments. Flow occurs when the challenges of the complexity are matched by the capability to meet them.

- An organisation in ‘flow’ has the capacity to ‘read’ the risks and make the most of the opportunities of its environment

- A person ‘in flow’ is able to make sound decisions in the face of uncertainty when he or she does not and cannot know what to do.

Opportunity lies in ‘flow’. Risk lies in misreading the complexities of the environment and applying models, risk analysis and management techniques appropriate for a less complex environment. At minimum such misreading is inadequate, at maximum it increases risk. For example taking what has been described as the ‘convoy’ (one by one) approach to banks in the US when the risk was systemic.

We use a framework of levels of complexity to refine the idea of ‘flow’ and to look more closely at the relationship between the environment, the work and decision-making.

Levels of Complexity

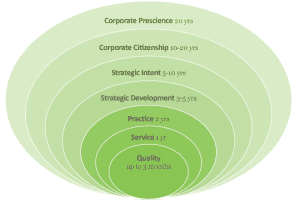

The first three levels are concerned with operational risk and compliance.

At the first level risk lies in non-compliance with prescribed procedures and failure to exercise judgement in direct response to immediate tasks. The role of risk analysis is daily to monitor exposure to risk and report on it. This ensures that any undue exposure (financial, safety, health) is immediately recognised and acted upon.

At the second level risk and opportunity lie in the quality of professional and technical responses to particular cases/situations. The organisation may have to ‘hold’ the risk for up to a year before adequacy of response can be evaluated.

This approach to risk and opportunity is appropriate in an environment where situations are sufficiently self-contained to be dealt with one by one.

At the third level risk and opportunity lie in systems, practices, and in the unintended consequences of changes in process and/or development of new products. The organisation may have to hold the risk for eighteen months or two years before the consequences play out.

This approach to risk and opportunity is appropriate in an environment where challenges hang together in series, cause and effect relationships are stable and knowledge is established and held by recognised groups (in other words in linear environments where extrapolation is entirely valid).

At the fourth level the risk and the opportunity lie in the value proposition (which includes market and capital risk). The questions to be asked at this level are where is value being created? Where is it being lost? Where destroyed? Where is it latent? It may be three to five years before they can comprehensively be answered and the organisation must hold the risk for that time.

This approach to risk and opportunity is appropriate in an environment where multiple interactions between organisations, markets, public services, regulators generate complexity that requires a comprehensive response. Scenario planning and probabilities are appropriate in this “disturbed, reactive” environment that gives rise to systemic risk.

At the fourth level risk also lies in the models used to design and project completely new products and services – as an investment banker put it, “when we create models inevitably we simplify, and in so doing consciously blind ourselves to much of the reality which seems extraneous to our immediate aims. But this has its dangers because as we all know, things change”.

At the fifth level the risk and the opportunity lie in reputation – arguably the greatest value for an organisation and “perhaps the most serious hazard for business” because it may take many years to recover. Loss of reputation decreases perception of good investment and increases cost of capital. Good reputation ensures ‘license to operate’ and continuity of investment.

Sustaining reputation in a very complex environment requires going beyond probability to engage the possibilities that lie in uncertainty. Very complex environments are full of “surprising, novel, obtrusive events with unknown causes, unknown remedies, unknown urgencies, unknown times to completion and unknown compounding factors that will create additional complexity at later points in the process”. In short, they are full of possibility.

At the sixth level the risk and opportunity lie in latent urgencies – those situations where action must be begun years before the situation which it is to meet is presently visible and where the last possible moment for effective response may pass long before the need for it is even noticed. Energy security and global financial regulation are good examples.

Risk and opportunity are managed by discerning sources of strategic opportunities and instabilities, by gathering intelligence about what is and what is not (yet) happening in all the spheres that could conceivably influence events.

Gillian Stamp. Bioss. April 2009

Recent Posts

Categories

- 360 Leadership Survey

- Assessment

- Capability

- Career Path Appreciation (CPA)

- Change Management

- Coaching

- Consulting

- Employee Engagement

- Flow and Engagement

- Leadership

- Marketing

- Neuroscience

- Organisational Design

- Performance Management

- Personal Development Analysis (PDA)

- Personality

- Strategy

- Structural and Talent Analytics

- Systems

- Talent Management

- Training